Ripple Price Fintechzoom – Let’s Find Out!

6 min read

Tracking Ripple’s price on FintechZoom has been a rollercoaster, mirroring my crypto journey. From initial excitement to cautious optimism, each dip and surge teaches me valuable lessons about market dynamics and personal finance.

“Ripple price FintechZoom” reflects Ripple’s cryptocurrency’s fluctuating value, offering investors insights. FintechZoom’s coverage tracks Ripple’s performance, providing valuable information for those interested in the digital asset market.

We explore the factors influencing Ripple’s price, such as the regulatory environment and adoption by financial institutions. Finally, we touch on price predictions and technological advancements shaping Ripple’s future.

What Is Ripple? – Let’s Discover!

Ripple is a digital payment protocol and cryptocurrency that aims to make international money transfers faster, cheaper, and more reliable. Unlike traditional payment systems, Ripple does not rely on a centralized authority like a bank or government. Instead, it uses a decentralized network of servers and a digital currency called XRP to facilitate transactions.

Ripple’s technology allows for near-instantaneous cross-border payments, benefiting businesses and individuals who need to send money across borders quickly. Additionally, Ripple’s system is designed to be highly secure, with transactions being recorded on a public ledger known as the XRP Ledger.

Overall, Ripple represents a new way of transferring money, leveraging blockchain technology to revolutionize how we send and receive funds globally.

The Historical Performance Of Ripple – Let’s Learn!

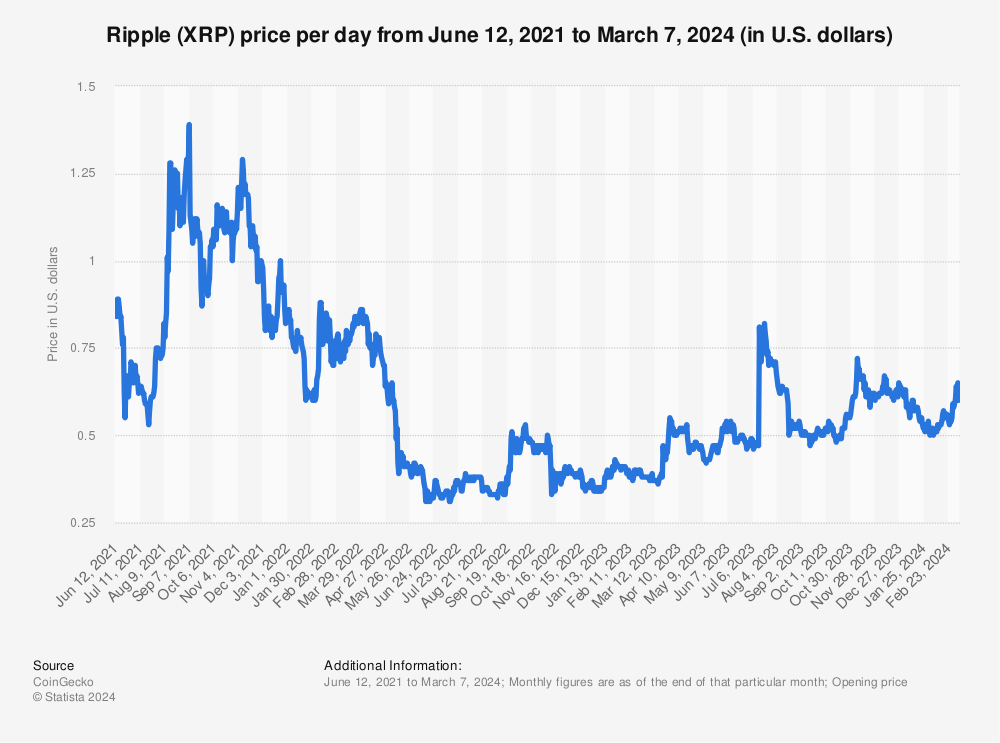

Ripple, or XRP, has had a dynamic history in the cryptocurrency market. Since its inception, Ripple has experienced significant fluctuations in price, driven by various factors, including market demand, investor sentiment, and regulatory developments. In its early days, Ripple’s value was relatively low, hovering around zero.

However, in 2017, Ripple saw a meteoric price rise, reaching an all-time high of $3.84 in January 2018. This surge was primarily attributed to partnerships with major financial institutions like American Express and Santander, which increased confidence in Ripple’s technology and its potential to revolutionize the financial industry.

Despite its past volatility, Ripple remains a crucial player in the cryptocurrency market, with its price closely watched by investors and traders alike.

1. The Early Days:

In the early days of Ripple, the cryptocurrency was just gaining traction in the market. Founded in 2012 by Chris Larsen and Jed McCaleb, Ripple aimed to revolutionize international money transfers. At the time, the value of XRP, Ripple’s native cryptocurrency, was negligible, trading close to zero.

However, despite its humble beginnings, Ripple’s technology showed promise in challenging the status quo of the traditional financial system. Over time, Ripple’s vision and innovative approach would lead to significant developments in cryptocurrency, setting the stage for its later successes and growth.

2. Meteoric Rise in 2017:

In 2017, Ripple experienced a meteoric rise in price and popularity within the cryptocurrency market. During this period, XRP, Ripple’s native cryptocurrency, saw its value skyrocket to all-time highs.

Several factors, including increased adoption by major financial institutions and partnerships with companies like American Express and Santander, fueled this surge in price. Ripple’s technology, which aimed to streamline international money transfers, gained significant attention and credibility during this time.

The Current State Of Ripple Price – Let’s Take A Look!

The current state of Ripple’s price interests both seasoned crypto investors and newcomers. Ripple, also known as XRP, has shown significant price volatility, which is typical of many cryptocurrencies. This volatility means that the price of XRP can change rapidly, presenting both opportunities and risks for investors.

Market sentiment is crucial in influencing Ripple’s price, with positive news often leading to price increases and negative news leading to declines. Staying informed about Ripple’s price movements and market trends is essential for investing in XRP.

1. Price Volatility:

Price volatility refers to the degree of variation in the price of an asset over a specific period. Price volatility is a common characteristic in the context of cryptocurrencies like Ripple (XRP). XRP’s value can experience significant fluctuations in short periods, leading to both rapid gains and losses for investors.

Factors such as market demand, investor sentiment, regulatory developments, and overall market conditions can all contribute to the volatility of Ripple’s price. Traders and investors must know this volatility and manage risk accordingly when dealing with XRP.

2. Market Sentiment:

Market sentiment refers to the overall attitude or feeling of investors and traders towards a particular asset, such as Ripple (XRP), in the cryptocurrency market. It reflects the collective mood of market participants, influencing their buying and selling decisions.

Positive market sentiment can increase buying activity and rising prices, while negative sentiment can result in selling pressure and price declines. Various factors, including news, events, rumours, and broader economic conditions, often influence market sentiment. Understanding market sentiment is crucial for traders and investors as it can impact price movements and market trends.

The Future Of Ripple – Discover The Possibilities!

The future of Ripple (XRP) is subject to various factors that could shape its trajectory. Price predictions for XRP vary widely, with some analysts forecasting significant growth while others remain cautious. Technological advancements, such as improvements to the Ripple network, could play a key role in determining its future value and acceptance.

Additionally, regulatory developments, particularly regarding the SEC’s actions against Ripple, will likely continue to impact its price and market position. Overall, the future of Ripple remains uncertain, and investors should carefully assess the risks before making investment decisions.

1. Price Predictions:

Predicting the future price of Ripple (XRP) is challenging due to the volatile nature of the cryptocurrency market. While some analysts forecast significant growth for XRP, others are more conservative.

Factors such as market sentiment, regulatory developments, and technological advancements will all play a role in determining XRP’s future price. Investors must conduct thorough research and consider the risks before making investment decisions based on price predictions.

2. Technological Advancements:

Technological advancements are crucial in shaping the future of Ripple (XRP). Ripple Labs, the company behind XRP, is constantly improving its technology to enhance the efficiency and security of its payment network.

One of the critical areas of focus is the development of the RippleNet platform, which aims to revolutionize cross-border payments by providing fast, reliable, and cost-effective transactions. Additionally, Ripple is exploring new use cases for its technology, such as decentralized finance (DeFi) and non-fungible tokens (NFTs), which could further increase the adoption and value of XRP.

Frequently Asked Question:

1. What is XRP, and how is it related to Ripple?

XRP is the native cryptocurrency of the Ripple network. It is used to facilitate transactions on the network and can also be traded on various cryptocurrency exchanges.

2. Is Ripple a good investment?

This depends on your investment goals and risk tolerance. Like all cryptocurrencies, Ripple’s price can be volatile. It’s important to do your own research and consider speaking with a financial advisor before investing.

3. What are some use cases for Ripple’s technology?

Ripple’s technology can be used for a variety of applications, such as cross-border payments, remittances, and real-time gross settlement systems. It can also be used for tokenizing assets and facilitating decentralized exchanges.

4. What is the current regulatory status of Ripple?

The regulatory status of Ripple varies by jurisdiction. In the United States, Ripple has faced legal challenges from the Securities and Exchange Commission (SEC) over whether XRP should be classified as a security.

Conclusions:

Ripple’s price on FintechZoom, exploring its past performance, current state, and future potential. It highlights Ripple’s historical performance, market volatility, and factors influencing its price.

Read: